Recommendations for tourism statistics Tourism statistics represent a useful tool to support decision-making in business and in the private sector. To make provision for adequate and suitable air and sea passenger transport services to and from Barbados.

Tell us more.

. Tourism Revenues in Sri Lanka averaged 17909 USD Million from 2009 until 2022 reaching an all time high of 47520 USD Million in December of 2018 and a record low of 050 USD Million in December of 2020. Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Data research on tourism hotels inc.

The best places for huntingfishing. Medical tourism is a significant sector of Malaysias economy with an estimated 1 million travelling to Malaysia specifically for medical treatments alone. Ministry of Tourism Arts and Culture Malaysia Official Portal MOTAC Tourism Arts Culture.

Tourist Arrivals in Malaysia increased to 41496 in March from 26760 in February of 2022. Malaysias minister of tourism arts and culture Nancy Shukri has appointed Ong Hong Peng as the new chairman of Malaysia Tourism Promotion Board effective August 4 2022. Tax rebate for Self.

National Anti-Corruption Plan NACP Contact Us Ministry of Tourism Arts and Culture No. ROYAL MALAYSIAN CUSTOMS DEPARTMENT LEVEL 4 BLOCK A MENARA TULUS NO 22 PERSIARAN PERDANA PRECINCT 3 62100 PUTRAJAYA FEDERAL TERRITORY MALAYSIA https. The withholding tax rate for both services and royalties is 10 but depending on the tax treaty between Malaysia and the respective countries the rate may be further reduced.

Malaysia has signed tax treaties with over 75 countries including most countries in the European Union the United Kingdom China Japan Hong Kong Singapore Australia. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. Tourism Revenues in Sri Lanka increased to 17360 USD Million in February from 14810 USD Million in January of 2022.

Tourism investment requirement for providing utilities can play a critical role. ROYAL MALAYSIAN CUSTOMS DEPARTMENT LEVEL 4 BLOCK A MENARA TULUS NO 22 PERSIARAN PERDANA PRECINCT 3 62100 PUTRAJAYA FEDERAL TERRITORY MALAYSIA https. Global Forum on Tourism Statistics Food Tourism Experience climate change tourism Tourism Satellite Account int.

Promoting my Berkeley county business. This page provides - Malaysia Tourist Arrivals - actual values historical data forecast chart statistics economic. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as other sectors such as those involved in Islamic financial services ICT education tourism healthcare as well as research and development.

Can the Tourism Office contact me about. To encourage the establishment of. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

This page provides - Sri Lanka Tourism. Musical events in the County. You will be granted a rebate of RM400.

BTMI functions are to promote assist and facilitate the efficient development of tourism. Tourism has the potential to promote inclusiveness. In a separate statement MATATO said this may not be the optimal time to implement tax increments and that the full implications should be taken into consideration including its impact on the nations primary revenue.

If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. Tourist Arrivals in Malaysia averaged 155305708 from 1999 until 2022 reaching an all time high of 2806565 in December of 2013 and a record low of 5411 in May of 2020. Step 1 of 3.

To design and implement suitable marketing strategies for the effective promotion of the tourism industry. If any new or existing company plans to expand modernize or refurbish to provide private healthcare facility which benefits a minimum of 5 of healthcare travelers out. This tax rebate is why most Malaysia n fresh.

The existing standard rate for GST effective from 1 April 2015 is 6. Tax income generated from tourism can be reinvested in health care and services. The tourism industry has repeatedly raised concerns over the tax increment saying it makes the destination costlier.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. For the smaller companies the rate is 19. Having began his service in the government sector in 1981 Ong has held multiple appointments in the Ministry of Tourism Arts and Culture.

The Barbados Tourism Marketing Inc. Tourism can empower women particularly through the provision of direct jobs and income-generation. In 2016 the Inland Revenue Board of Malaysia lowered the effective tax rate to 24 for businesses with capital exceeding 25 million ringgit.

7 Tips To File Malaysian Income Tax For Beginners

Ecer Incentive Packages Ecerdc

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

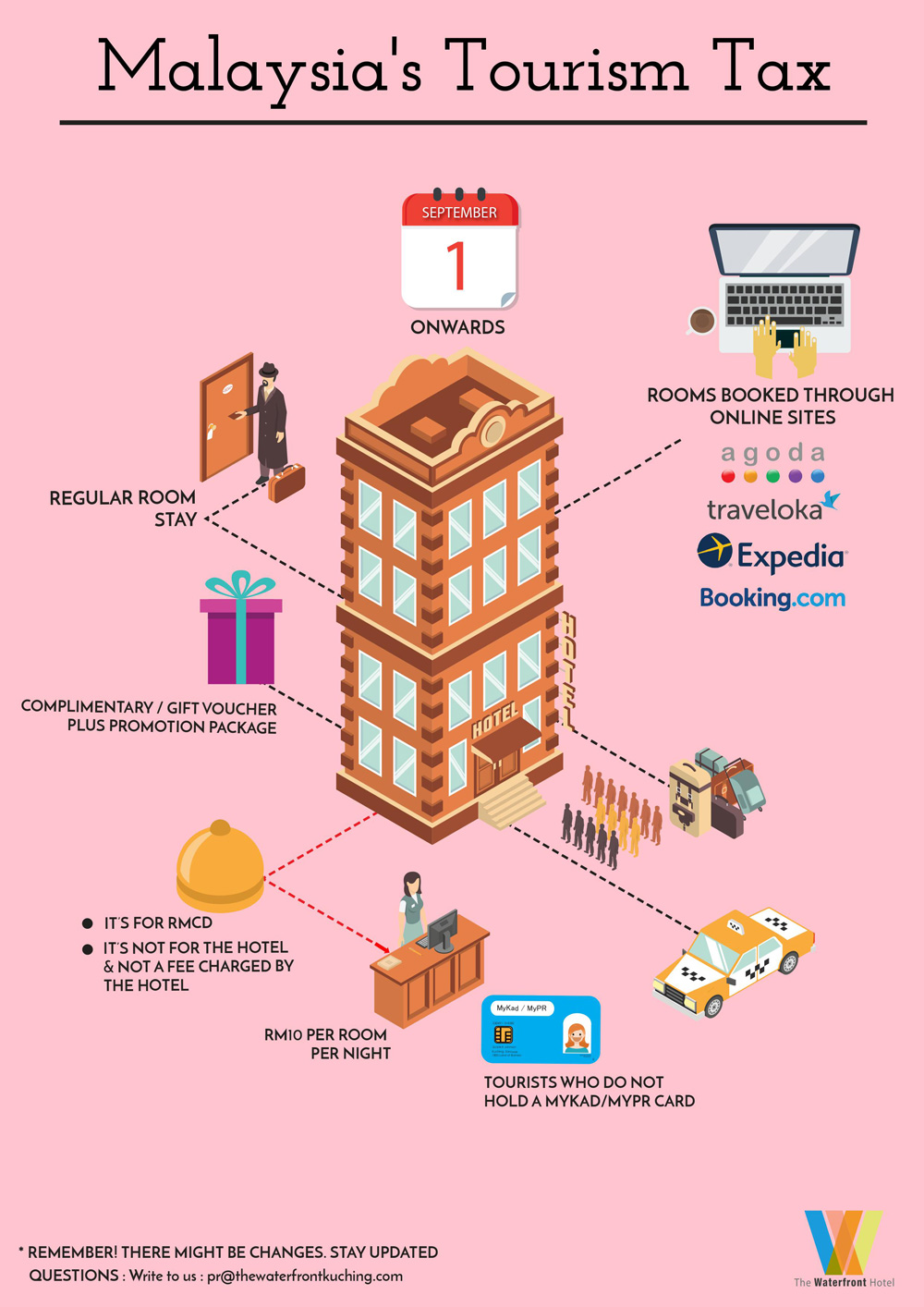

Malaysian Tourism Tax The Waterfront Hotel

Airbnb Welcomes Tourism Tax For Short Term Accommodation

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Air Travel Taxes The Travel Insider

Pdf The Effect Of Tourism Taxation On Tourists Budget Allocation

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2022 Ya 2021

Guide To Tax Refund In Malaysia Bragmybag

Eastwood Valley Golf Country Club Rooms And Suites

Malaysian Tourism Tax The Waterfront Hotel

Cukai Pendapatan How To File Income Tax In Malaysia

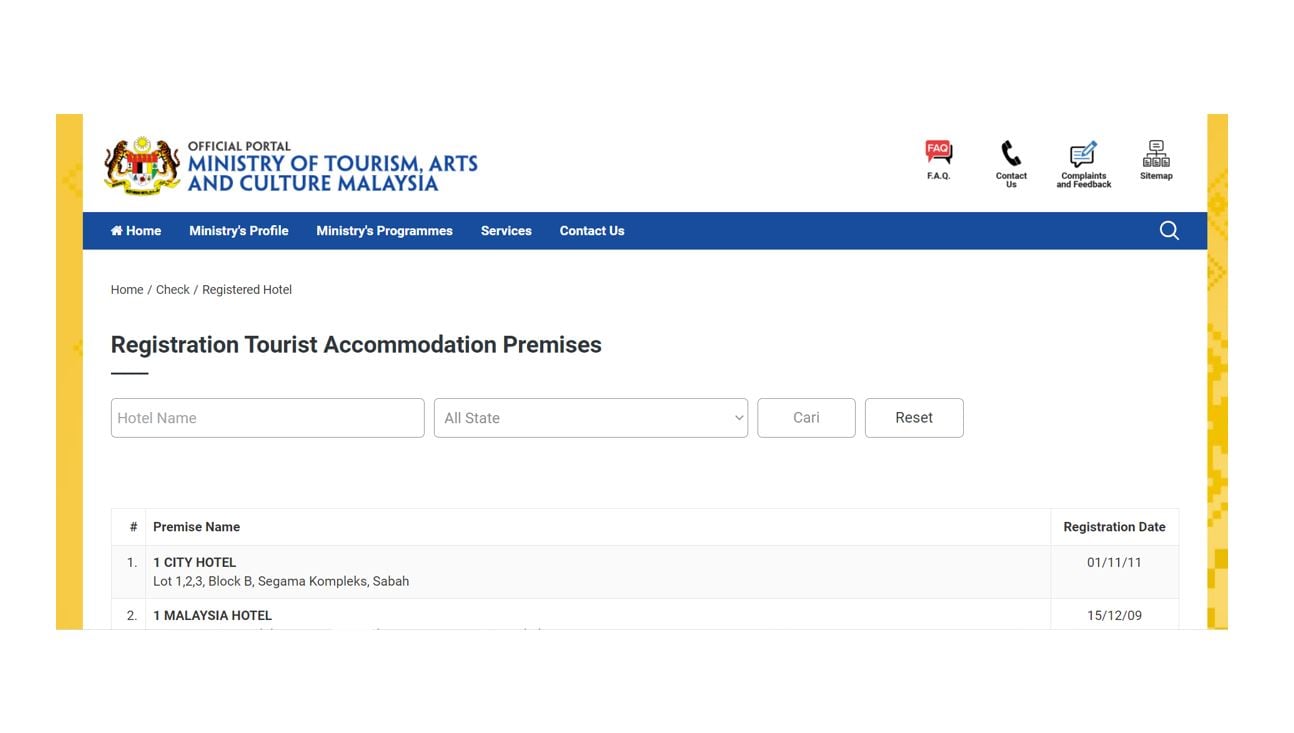

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief